Table of Content

When I added the works to my State Farm test policy, my monthly premium was still only $138. The works, in this case, were $65,000 in additional replacement cost property coverage , water backup insurance, special computer coverage, and earthquake coverage. You’ll need to work with an agent in order to buy your policy; medical exams are required for most applicants. A 33-year-old healthy woman can buy $500,000 in 30-year term coverage from State Farm for just under $35 a month, according to the online quote generator. This doesn’t include any optional coverage such as a disability waiver of premium, child or spouse protection, or a select term rider.

This is a helpful add-on for those with high net worth. Sump pump and drain backup covers water damage caused by a faulty sump pump or drain backup. Home systems protection helps replace several types of home systems, including water filtration systems, air conditioning systems and power generators. Full replacement cost covers the actual cost to rebuild your entire home. Incidental business coverage for people who work from home.

Can a Senior Citizen Get Mortgage Protection Insurance?

Coverage options are selected by the customer, and availability and eligibility may vary. Previous content is a carousel of links to 12 Simple Insights articles. Next content is a carousel of links to 12 Simple Insights articles. To navigate carousel you use buttons below carousel to change carousel card to next or previous card. Looking for help protecting your family, cars, home and future?

This information contains only a general description of available coverages and is not a statement of contract. All coverages are subject to all policy provisions and applicable endorsements. 1 Customers may always choose to purchase only one policy, but the discount for two or more purchases of different lines of insurance will not then apply. Savings, discount names, percentages, availability and eligibility may vary by state. You don’t own the place, but you own the property inside it.

Guaranteed Level Term Mortgage Life Insurance

All financial products, shopping products and services are presented without warranty. When evaluating offers, please review the financial institution’s Terms and Conditions. If you find discrepancies with your credit score or information from your credit report, please contact TransUnion® directly. But State Farm’s most popular sister coverage is auto insurance. It’s cheap, stacked with smart perks, and available just about everywhere. When you bundle your auto and homeowners policies, the savings can be significant.

Its death benefit stays the same, and it typically saves you money over antiquated mortgage insurance plan #1. For example, if you have a 30 year mortgage, most agents will try to automatically sell you a30 year term policy, whose death benefit stays levelduring the entire 30 years. MOST agents will sell you this type of life insurance for mortgage protection. I also floated State Farm a $16,000 loan for several months because the contractor expected to be paid upon completion of the job. I gave State Farm 3 stars rather than a lower rating because I expect that most insurance companies' claims experiences are this disappointing. This insurer offers comprehensive homeowners coverage and personalized service through its agents, but very few discounts.

The Average Home Insurance Cost in the U.S. for December 2022

We use intelligent software that helps us maintain the integrity of reviews. 4,155,775 reviews on ConsumerAffairs are verified. There’s plenty of useful information for homeowners on the State Farm site, though it sometimes takes a little scrolling to find. Keep an eye out for the Simple Insights section of the site for in-depth tips. Reimbursement for certain costs related to building codes or zoning laws. Coverage to replace a damaged water heater, air conditioner or heating unit with a more energy-efficient model.

The “increased dwelling limit” automatically extends your replacement coverage up to 20%, as long as you’ve insured your home at least up to its estimated replacement cost. You won’t pay anything to add this to your policy. When we reviewed Lemonade’s homeowners policies, we discovered incentives to drive less. Popping to the supermarket for a gallon of milk might save a little time, but, personally, I’m down with saving a few bucks by walking.

Pay and manage your insurance bills

No one else came for weeks, despite multiple calls from Ms. Huskey insisting that the insurer send someone to inspect her roof. State Farm eventually sent a man who worked for an independent company but had been contracted to help. This second visitor said it wasn’t clear that the damaged roof was the source of the leaks in the house. “We were looking for a place where it’s comfortable, quiet, secluded, where people can’t just come to your door and ring your doorbell,” Ms. Huskey said. When she first saw the house, she was attracted to the broad back deck, where she would later spend time relaxing in the sun, even on the hottest days of the year.

Unusually, State Farm has separate plans for dogs and cats. What’s common to both policies is Trupanion’s inclusive coverage. They won’t turn your breed down like some insurance providers we’ve looked at. There are no settlement limits either, and you have access to medical experts 24/7. While State Farm’s basic HO-3 policy is generous, it doesn’t cover everything. (No basic plans we’ve found do.) But you can beef up your State Farm home insurance plan easily, and it’s surprisingly affordable.

Policies are available in 49 states and the District of Columbia, though coverage is not offered in New York. State Farm agents can be there when their customers need them most. In the beginning, agents provided insurance to farmers. Pick from four simple options if you need to file a home insurance claim.

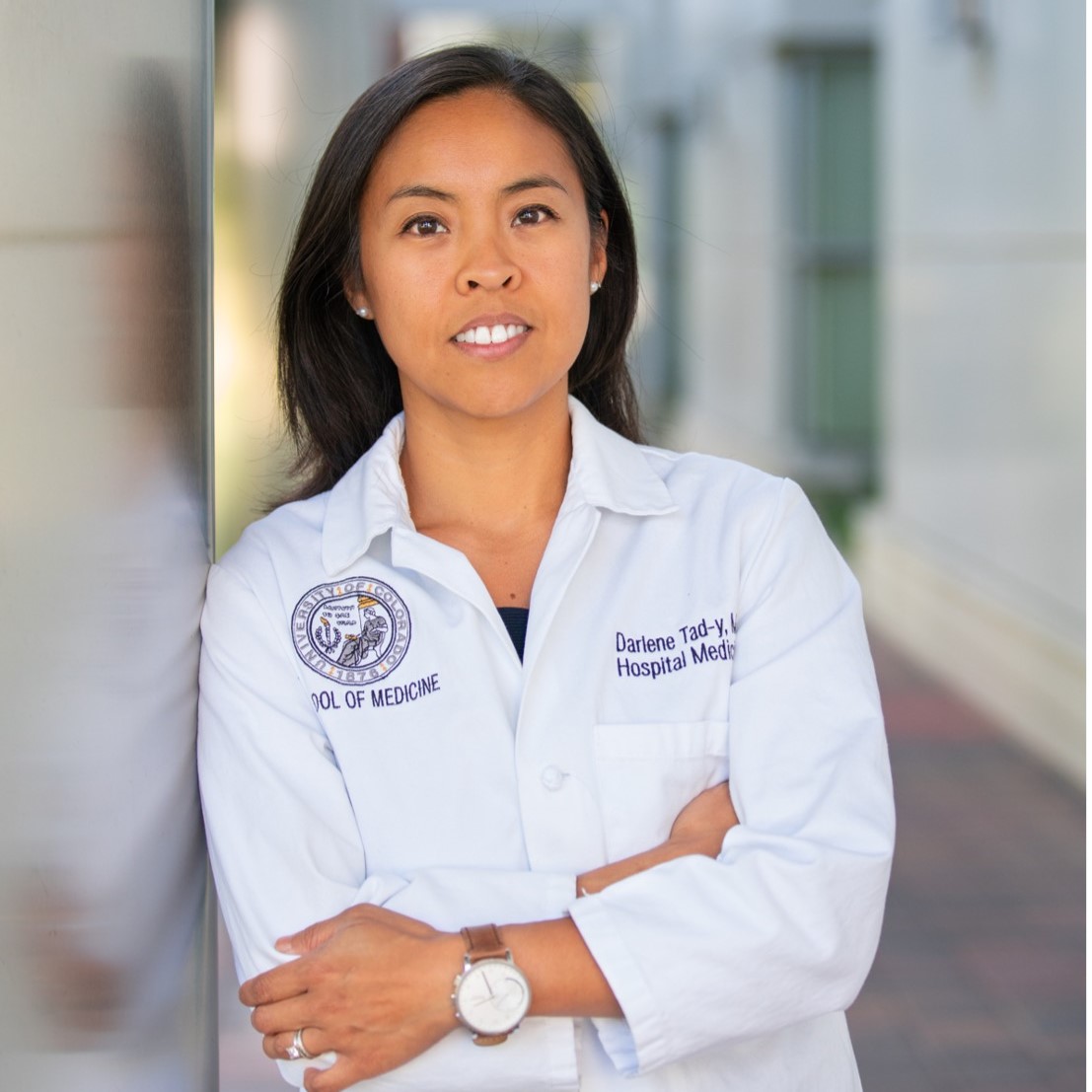

For most white customers, the process typically took fewer than three interactions before claims were approved. White customers were also one-third more likely to have their claims paid out in less than a month. Jacqueline Huskey, a Black woman living in suburban Illinois, tried more than a dozen times to get help from State Farm after a hailstorm punched holes in her roof. Now, thanks to a broad study of how the insurer handles claims like hers, she has evidence indicating that her struggle is a common one for Black customers. Our 19,000 insurance agents are ready to help you start bundling. Not all products listed above are available in all states.

The group chose to focus on State Farm because it is the nation’s largest provider of insurance to homeowners. Ms. Huskey is suing State Farm, and the study is the basis of the lawsuit. It is the first of its kind to use company-specific data to highlight racial bias, which is difficult to prove. In order to take out a reverse mortgage, homeowners need to be at least 62 years of age, among other requirements. USAA holds an A++ rating from AM Best, which is the highest possible financial strength rating. State Farm also holds an A++ financial strength rating from AM Best.

Life Insurance Study, which takes into account factors such as consumer satisfaction and customer service. But, you still may be able to purchase flood insurance if your community participates in the National Flood Insurance Program . In fact, most flood insurance is written through the NFIP, administered by the Federal Emergency Management Agency . It normally takes 30 days from the date of purchase to go into effect. So don't wait until a flood is imminent to buy a policy.

Best Mortgage Protection Insurance Companies of 2022

Never needing to actually use your life insurance coverage is obviously a good problem to have. If you’ve paid premiums for decades just to have your term policy expire, though, it would still be nice to get a little of that money back in the end. As an independent life insurance agency that offers policies from over 40 of the best rated life insurance companies in America, we are able to offer the most affordable premiums in the industry. However I do try and refrain from being frivolous with submitting claims just because. Most policies with State Farm cost between $1,500 a year and $3,000 a year. That comes out to between $125 and $250 a month.